Has it always been your dream to be an entrepreneur? Do you wish to set up a startup business in the U.S.? If so, your dream can come true if you take the right steps. Emphasis on the “right”. As a startup entrepreneur, you want to make all the right choices and take all the right steps. Sure, mistakes can happen. However, if you can avoid as many mishaps as possible, the journey toward your dream can be a lot less stressful.

So, how do you set up a startup business in the US? What exactly are the right steps you have to take? Well, we are here to unpack it all to help you out. We plan to discuss the procedure for U.S. citizens and the process for non-U.S. citizens to set up a startup business in the US.

You could be a U.S. citizen or not. Regardless, you will find the path to your dream if you scroll through.

How to Setup a Startup Business in the US: Procedures for US Citizens

So, are you a U.S. citizen who wishes to set up a startup business in the U.S.? If so, there are a few steps you have to take. Whatever your level of experience, this tried-and-true guide to starting a business will assist you through the whole process, from selecting and verifying your money-making concept to determining the best delivery method and launching your product or service. The purpose of this checklist is to help aspiring business owners grasp the fundamentals of getting their venture off the ground.

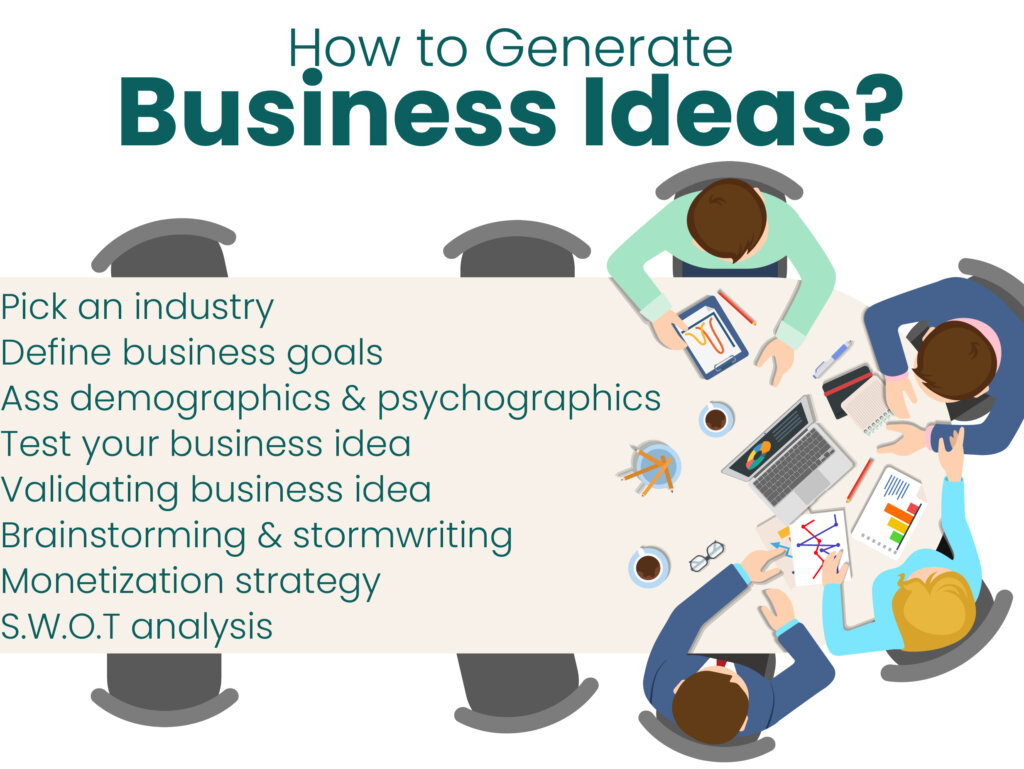

Step 1: Figure out your business idea

The first step is obvious, isn’t it? Well, it is, but it is also the most crucial step you have to take first. Take time to figure out what you want your business to be. That is the first step to starting out in any business. We would recommend generating small business ideas in your case. Also, note that the business idea should be well-defined and the boundaries of the business must be portrayed.

Step 2: Make Notes on Your Business Plan

As long as you’re aware of all of your “known unknowns,” you don’t have to worry about finding a solution at this moment. Maybe you are not sure how to start writing it. Do not worry, though. We can help you plan what to include in your business plan. Make sure that the following are in your notes:

- Your startup’s name and a description of what it is

- Market analysis

- Management and organization

- Products and services you want to provide

- Customer segmentation

- Your marketing plan

- Logistics and operations plan

- Financial plan

As you know, your business name is a crucial part of the startup. The name you choose is what your business is going to be called. And that is how your customers identify it. So you better take careful consideration of what you want to call your business. We would recommend it be something simple, memorable, and short.

Think about some of the successful startup businesses in the market. The names are easy to remember, simple, and have an instant click when you hear them. That is what you need for your startup as well. Do not forget that the name you pick should also reflect what your business is about. It would be great if it gave an insight into the mission and vision of your startup as well.

Conduct thorough market research

What is your target market? What sort of services and products are potential customers looking for? Also, who are your biggest competitors? What do they offer to the customers? You can find answers to all those questions through proper market research. A startup business needs to conduct a market analysis to come up with the perfect business plan.

What is the potential opportunity size?

Are you one of those entrepreneurs who are quite dismissive of small markets? Maybe you are, like most entrepreneurs. However, we urge you to think differently on this matter. For instance, suppose a product category has few active customers. Still, the product’s cost could be relatively high. It could even require re-purchase. In that case, you would agree that it is a brilliant opportunity that entrepreneurs focused on market size might miss.

Understand your competition

Do you notice a lot of competition in the market? Suppose there are many competing businesses in your niche. It indicates that the market is well established. Being aware of that makes you realize that there is a demand that exists. However, it is also a sign for you to identify what you can bring to the table. How can you determine what you have to offer to earn a loyal customer following? That is something to think about and find answers to.

Understand your target audience

It is essential to figure out your target audience. Understanding them is one of the first steps you need to take to build a successful startup. Knowing what your potential customers need makes it easier to sell the products and services effectively.

You can also attract new customers to check out your services. Make sure to engage more in social media and run promotional ads. It will help understand and build a good relationship with your customers.

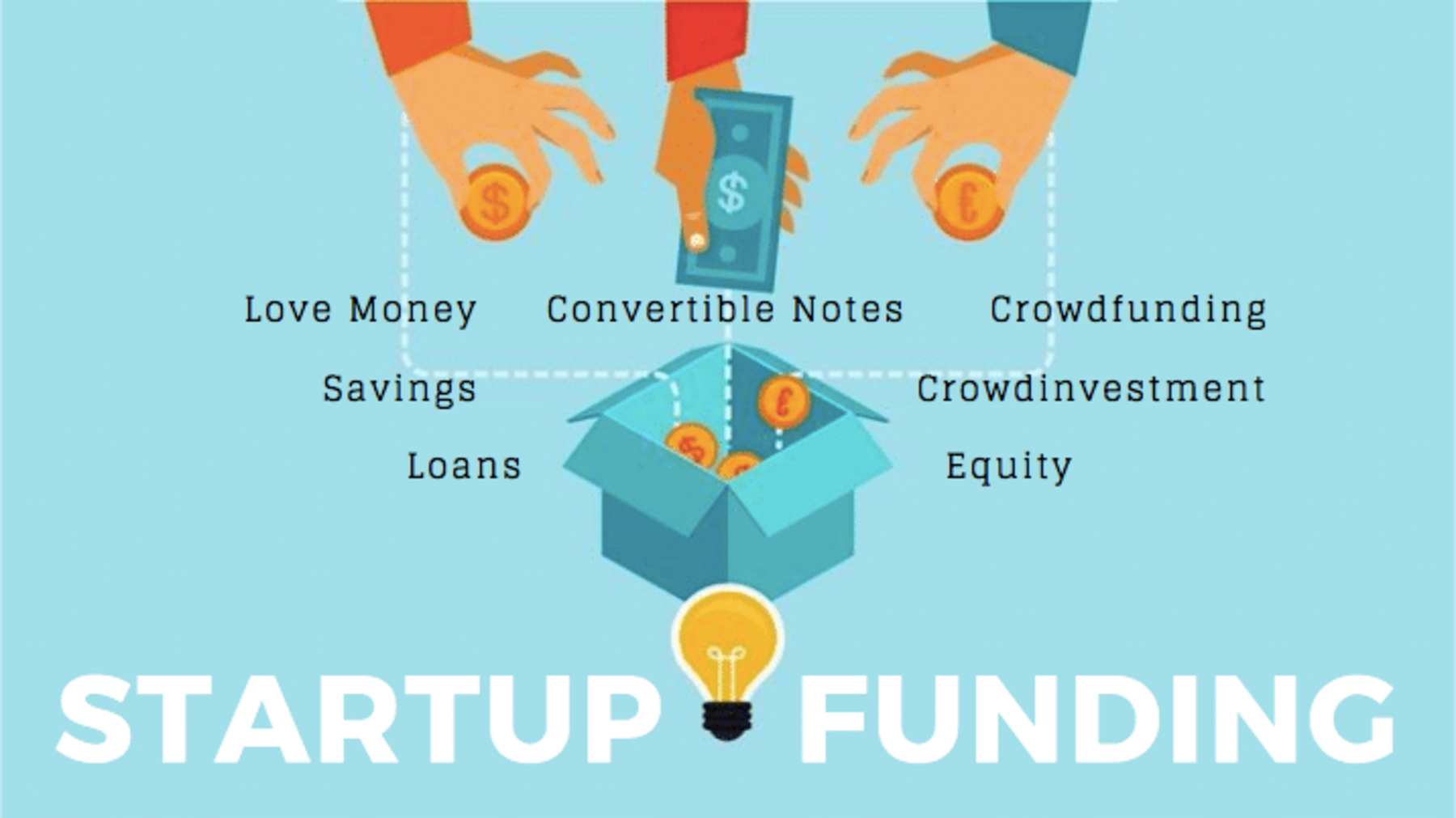

Step 3: Secure Financing to Fund Your Business

The business plan you craft will give you an idea of how much funding you will need to run the business. Once you know that, you have to find ways to fund your startup. We listed some of the methods you can use to get the money you need for your business. Take a look:

Business grants

Grants are usually offered to startup businesses by considering factors such as minority-owned, specific for-profit, veteran-owned, and women-owned.

Business loans

Suppose you have earned a good personal credit history. In that case, you can expect to get a business loan from a lender to fund your startup.

Crowdfunding

Maybe you are not a fan of the traditional funding route. In that case, you could always crowdsource money from a group of people online.

Personal investors

You can also get funds from VC or angel investors, which is a common method used by startup entrepreneurs. Apart from that, you can ask for money from your friends and relatives, if it is not a burden to them, of course.

Step 4: Figure Out Your Business Structure

Next, you have to pick the perfect business structure for your startup. So, what is it exactly? Well, a business structure is about balancing the legal and financial protection your business requires. Here, the catch is that you have to consider the flexibility offered by different options. Remember that it is a crucial decision you have to make cautiously before you launch your startup.

Business structures vary according to your location. The most common types include limited liability companies (LLCs), sole proprietorships, and corporations. Let us discuss each of them one by one.

Limited liability corporation (LLC)

A limited liability corporation, a.k.a. LLC, is a common kind of small business entity in the US. It works by offering liability protection to you, the business owner. That way, you are not financially responsible if any legal claims come up against your startup business.

You can get an LLC as the only owner of the business or even if your business has multiple partners. Note that LLC policies change depending on the location of your startup. For example, it could differ from California or Texas. Remember to check the state-specific guidelines for your state.

Sole proprietorship

Are you the only person in charge of the startup? If so, you can opt for a sole proprietorship, which works great for such cases. Plus, it is relatively the lowest-effort structure to pursue. However, it leaves you personally liable for your startup business and its functions.

If you choose to be a sole proprietor, you have the chance to hire employees. To do that, you are required to get an employer identification number (EIN). That means you have to register your startup business entity.

C Corporation

Generally, a C corporation refers to a business structure where proprietors get taxed separately from the entity. Here, the shareholders have ownership of the business and each has a fractional share of the business. Usually, C corporations benefit large, multinational corporations. Nevertheless, they can be leveraged by small businesses that wish to garner investment by issuing stock.

Let us discuss legal structure factors now

What type of business is your startup?

Remember that your business scale matters when choosing a structure. Certain structures work best for startups of a certain scale or within a certain industry. Over time, you might need to consider restructuring when you go on to create partnerships. For example, a lot of large businesses request that their partners or suppliers be incorporated.

The number of people involved

Suppose you are a solo founder. In that case, you will have the chance to look at streamlined options. However, let’s suppose you have one or more business partners or co-owners in the company. Here, you will have to take a slightly different route. You will have to consider more advanced options to make sure things are set up and shared correctly.

Step 5: Obtain Federal and State Tax ID Numbers

Federal Tax ID (EIN)

A federal tax ID, a.k.a. an employer identification number (EIN), is assigned to businesses and organizations by the IRS for tax purposes. The nine-digit number helps identify your business, working similarly to a Social Security number.

So do you need an employer identification number? Well, it depends. You will need to obtain an EIN if you meet the following circumstances:

- If your business is incorporated,

- If you have any business partners,

- If your business has any employees apart from yourself,

- If you take over an existing business, either through inheritance or purchase,

- If you have a solo 401(k) retirement plan or a retirement plan for self-employed workers like a keto plan,

- If you wish to set up a bank account,

- If you file for bankruptcy,

Suppose you have an employer identification number. How does it help you and your startup? Take a look at the list of benefits you can obtain:

- It helps you when you file taxes.

- It helps keep your personal information safe.

- It helps you establish credit.

- It protects you legally.

- Tax ID

State tax ID

Now let us talk about state tax ID. A state tax ID differs from an employer identification number. As we mentioned earlier, the federal IRS assigns the EIN. On the other hand, a state tax ID is obtained through your state.

So, how does a state tax ID work? Well, it serves a pretty similar purpose to an EIN. A state tax ID helps your startup business comply with state laws. Keep in mind that different states have different regulations, requirements, and tax laws. That is why you must do your research on your state’s laws to determine if your startup needs a state tax ID or not.

You can get the necessary information from your state’s taxation department, department of treasury, or secretary of state. That will help you understand the state tax requirements for your business.

Step 6: Obtain Business License and Permits

As an entrepreneur hoping to set up a startup business, you have to look into what local, state, and federal licenses you want to obtain to operate legally. Sure, it can be confusing if you are not that familiar with the law. In that case, we would recommend getting advice from a small business lawyer on this matter before officially starting your business.

Your startup needs to align with the laws governing businesses in your region, as well as laws and regulations specific to your industry.

Step 7: Create a Business Bank Account

You can manage your funds easily by opening a bank account specifically for your business. Once you open a business bank account, you can get a business credit card. It would make things far easier for you if you kept your personal and professional finances separate. For instance, you will be able to handle your taxes easily. Plus, it can also help you automate some of the financial steps of running a business.

Step 8-Obtain Business Insurance

One of the best proactive measures you can take to keep your business safe from any potential harm is getting insurance. Remember that laws regarding insurance differ from state to state. Some states do not even require obtaining insurance. Despite that, we would suggest that you get your startup insured. It is never a bad idea to take steps to keep your business as safe as possible.

If you hope to obtain insurance, you should be aware of the type of insurance you need. There are a lot of business insurance types. So, why don’t we go through each one of them to understand what they each offer?

Liability insurance

If you get liability protection insurance, it will cover your startup for legal actions caused by injuries, accidents, or negligence.

Insurance for commercial property

Commercial property insurance comes to the rescue when property damage occurs. It could be due to theft, storms, or fire. It helps you pay to replace or repair the damaged property and equipment you lost.

Commercial auto insurance

Commercial auto insurance can cover damage caused to or by vehicles you use for your business. It includes moving trucks, delivery vehicles, forklifts, and more. This type of insurance will provide funds for medical and legal bills and property damage if it is one of the vehicles you use that caused the accident.

Workers’ compensation insurance

This type of insurance pays for the lost wages or medical care of employees who get injuries on the job. When you do your research, you will find that many states expect employers to have some kind of workers’ compensation insurance. For that, you have to consider the number of employees you employ.

Professional liability insurance

Professional liability insurance is also known as errors and omissions insurance. This type of insurance protects employees who are in service-related jobs. It offers them protection from liability for negligence or malpractice. Bartenders, aestheticians, and hair stylists are some examples.

Product liability insurance

Product liability insurance offers protection to manufacturers, distributors, retailers, and wholesalers. Suppose a product they create or sell turns out to be unsafe for someone. For example, a makeup product that causes allergies. Product liability insurance offers protection from liability.

Business interruption insurance

Another type of insurance is business interruption insurance, which provides operating costs if it has to move or shut down. For instance, suppose a business had to shift due to a fire explosion. In that case, business interruption insurance will offer to pay for relocation, paying rent, and paying employees.

Cyber liability insurance

Cyber liability insurance offers liability coverage to startups that suffer data breaches. Some insurers even cover the cost of informing customers about the data breach and going on to assist customers who are victims of identity theft due to the cyber attack.

Umbrella insurance

Umbrella insurance offers you extra coverage to help pay for anything that may have exceeded your policy limits on other types of insurance.

Now you know the most common types of insurance and what they offer. So now it is time to decide on which ones to pick for your startup. We know it could be a difficult decision to make. What you can do is understand the risks of the industry you are in. That could help you choose the right insurance for your business.

Once you find the types of insurance your business requires, you can shop around. You can check out different insurance companies that offer a variety of insurance with different policies. The options can be endless and, I’m not going to lie, you may even feel overwhelmed. So, to avoid any stress, you can consult a reputable licensed agent to help you out.

The agent will be able to find you policies that match your business’s requirements and are also cost-efficient. We would recommend working with a reputable agent because it can help save you a lot of stress and energy. Plus, you can make an overall good decision on which type of insurance to pick.

Step 9: Take Advantage of Tools and Software

No startup entrepreneur should underestimate the value of good software. Why? Well, it does a lot more than you think. Suppose there are repetitive tasks that do not require you to make many decisions. Well, entrepreneurs usually use software for streamlining or automating these kinds of tasks. Plus, you can even deploy software early to support the marketing and sales work of your business as much as possible.

Below, we listed some of the software that you can benefit from to manage your startup.

Accounting

You can benefit from accounting software from the very beginning of your startup launch. Accounting software is an important tool for managing the financial data of your business, from simple invoicing and billing to tax calculations and project management. Additionally, it aids in managing customers, reconciling bank accounts, and generating analytical financial reports that assist in growing your business steadily and constantly.

Email marketing

You can benefit from setting up welcome email sequences even before you make your first sale. An email list comes in handy as it provides direct contact with your customers. Here, there is no third-party involvement. So that is a plus.

Advertisements

Running ads can help attract a larger audience to your business. Make sure to create ads that speak volumes to customers without so many words. Basically, your campaign should be simple but effective.

Project management

Remember that having one place to plan your work and keep track of important tasks can help you be on schedule. This applies to sole proprietors as well. You can rely on tools such as Asana and Trello. They can also help you stay in touch. Furthermore, you can get assistance from automation tools like Zapier. These apps help to stitch together and automate your common workflows. So try them out.

Website or online store

You can look for a website builder or an eCommerce platform that helps you take care of all the activities involved in operating your startup business. Find a theme that works with your product lines and lets you deal with orders conveniently.

Step 10: Hire employees

So far, we have discussed how to set up a startup business in the US. The next step is to find your team of employees. This is an essential part of your startup because the employees you choose will play a huge role in your business.

Think of how much work you need to do. What skills do you need to get your startup up and running? You have to carefully consider the answers to these questions. That is because they will guide both your level of investment and your timeline in the beginning.

Suppose you wish to do everything all by yourself. However, you are limited by the time you have to invest. Maybe you hope to build a team of employees. In that case, you will need to account for those costs—as well as the time involved in finding and onboarding freelancers or employees.

You might think you can handle all the work on your own. You may see hiring employees as an extra burden. However, you have to realize that there are so many roles to play, even in a small business. And it can be difficult to handle all those responsibilities all by yourself. That is when you can benefit from a competent team of employees. You can hire people for roles in your company, such as:

- Customer service coordinator: in charge of solving customer concerns and problems.

- Social media manager: in charge of growing your social presence

- Ads specialist: in charge of generating traffic to your official website.

- Graphic designer: in charge of creating assets for your marketing material

- Marketer: in charge of planning and writing content for your website and advertisement campaigns

Step 11: Market Your Business

Now it is time to market your business. For that, you have to brand your business.

We know that building a brand from scratch can be challenging. However, it is not like it has never been done before. Branding will help your business to stand out in the market. Note that a brand is not just the name and the logo of your business. It is how your customers see you whenever they interact with your startup.

Here are some of the elements to consider when building a brand:

Your logo

A logo is a specific visual representation that identifies your business. You can include text, colors, and images and make it your symbol. If your logo is effective, then it will express your vision and showcase what your business is all about in a simple way.

Your company’s colors and fonts

The colors and fonts you choose play a major role in your visual identity. Use them wisely to create yours.

Your voice, tone, and message

Keeping a consistent voice across all the touchpoints makes your brand sound more reliable. Ultimately, it helps you connect with your audience on a personal level more effectively.

Brand positioning

A brand position shows clearly who you want to serve. It tells your target customers why you are the best choice for them. Plus, it also shows what your products and services offer and how you stand out from the rest.

Create a website or online store

We would recommend starting launching an official website or an online store for your business. It is a smart way to gain profit and popularity among your customers. Having an online presence will gain credibility with potential customers and make it easy for them to access your business versus going to a physical store.

How to Setup a Startup Business in the US: Procedures for Non-US Citizens

Maybe you are a non-citizen with the dream of becoming an entrepreneur in the United States. You do not have to be a citizen or a resident to start a business in the U.S. You can make it happen. However, you may have to take a few extra steps as a non-citizen to reach your goal. Generally, the process is pretty similar to what a citizen goes through when starting a business.

From this point onwards, we hope to discuss how to set up a startup business in the US as a non-citizen. So keep reading to find out.

Step 1: Obtain the Necessary Federal Approvals

As you may already know, foreigners do not need a green card to own a business in the U.S. Similarly, a green card is not needed to be listed as a corporate officer or director of a U.S. company and earn profits from it if they pay taxes.

However, the process is different when you are a foreigner who works in a business that you have invested in. In that case, you should obtain approval from the U.S. government either via an E-2 Treaty Investor Visa or an EB-5 Visa. Let us learn a bit about them.

E-2: Treaty Investor Classification

How do you get approval to get E-2 Treaty Investor classification as a non-immigrant, non-citizen investor? Well, let us find out. Take a look at the following requirements:

- You should be a national of a country with which the U.S has a treaty of commerce and navigation.

- You should be active in the process of investing or have previously invested a substantial amount of capital in a bona fide American company.

- You should be in (or wish to be in) America for the sole purpose of developing an investment enterprise. Remember that you will need to show 50 percent ownership of the business. Alternatively, at least you need to show that you have operational control via a managerial position or some other corporate device.

For non-immigrants

Suppose you obtained an E-2 classification as a non-immigrant investor. Then it will allow you an initial stay in the U.S. of up to 24 months. You can expect to get extended stays of up to two years in increments. Luckily, you can request an extension as many times as you want. There is no limit to that. Despite that, E-2 investors should intend to leave the U.S. once the E-2 status expires.

Another important fact to keep in mind is that as an E-2 treaty investor, your business can operate the work you got approval for only once E-2 status has been granted. So suppose you are a non-citizen, non-immigrant, business owner. Then, you should be careful with your involvement in the startup.

It would be better to do your own research and be clear about the regulations. You can easily find all the details you want from the U.S. Citizenship and Immigration Services (USCIS) website. You can find out about the process and the forms you need to fill out to obtain E-2 classification.

EB-5 Visa Classification

The EB-5 visa program offers foreign investors who invest a particular amount of capital in a new commercial enterprise in the U.S. and create a minimum of 10 jobs the opportunity to apply. Suppose you want to invest in an area with high unemployment, which is called “targeted employment areas,” or TEAs. In that case, you have to invest $1,800,000, or $900,000. If you are a foreign investor who can obtain an EB-5 classification, you may become eligible for permanent U.S. residency.

Other than that, you can obtain EB-5 classification by investing through designated EB-5 regional centers. So what are EB-5 regional centers? Basically, they are economic units, public or private, in the United States. These units work to promote the economic growth of the country.

As we mentioned, you can expect to get conditional permanent residency in the U.S. thanks to the EB-5 visa. It is granted to you, the investor, and your family members. Usually, it lasts for 2 years. When it is 90 days before the two-year period expires, you can request for the conditional permanent resident status to be changed to lawful permanent status.

You can find out more about the process of obtaining EB-5 investor status by visiting the USCIS website. You can also get the necessary applications there.

Step 2: Choose a Business Entity Type

As a foreign entrepreneur, you may have certain limitations or restrictions regarding the business structures of your U.S. company. For instance, nonresident entrepreneurs may not form an S corporation. Why? Well, because every shareholder has to be a citizen. Otherwise, you should be a permanent resident alien, which refers to someone who is a permanent resident of the U.S. but does not have citizenship.

Usually, people choose the Limited Liability Company (LLC) and the C Corporation business entity types. That is because those entities provide personal liability protection for entrepreneurs. Plus, they offer some flexibility.

Whichever entity you choose, you have to file business registration paperwork in the state where your startup is set to function. They may have plans to operate the business in more than one state. You should file registration documents in all the states you wish to operate your business in.

Let us learn about each entity first.

C Corporations

C Corporations are regarded as separate legal entities (referred to as “shareholders”). As a result, entrepreneurs’ personal assets are protected from the financial and legal debts of the organization. Generally, the organization reports its losses and profits on a corporate tax return. Note that most financial institutions and outside investors usually choose to invest in companies set up as C Corporations rather than other kinds of entities. Why is that? Well, that is due to the compliance checks that are in place to make sure they are functioning well.

There are some cons when it comes to the C corporation structure as well. For example, the paperwork and deadlines required to stay in compliance. Other than that, double taxation is a potential downside as well. Note that sometimes the corporation’s profits are taxed twice. For example, the corporation pays taxes on the profits. Then, individual shareholders pay taxes on the dividend funds they get from the business.

LLC

LLCs are separate legal and tax entities from the business owners (referred to as “members”), so they offer personal liability protection for owners. LLC members get the luxury of choosing how they wish the business to be taxed. For example, they can choose the business to be taxed as a C Corp or have the losses and profits pass through to the entrepreneurs’ personal tax returns. Similar to C Corps, LLCs should fulfill ongoing compliance requirements. However, it does not have to be to the same extent.

You have to pay income taxes to the U.S. IRS and the state like other business owners.

Step 3: Appoint a Registered Agent

Note that C corporations and LLCs should designate a registered agent in every state where they have filed forms to accept service of process on behalf of the organization. So what does “service of process” mean? It is about legal notifications, correspondence from the Secretary of State, and any other government notices.

You should remember that requirements for registered agents differ according to the state. We will let you know the general requirements that apply to all states. They are:

- The agent should be over 18 years of age.

- They should have a physical street address within the state.

- They should be available at that physical address during business hours.

You can find companies that offer registered agent services. We recommend visiting the Secretary of State’s office in the state where you created your U.S.-based startup. That way, you will be able to obtain the details of companies that are authorized, registered agents.

Step 4: Get an Employer Identification Number (EIN)

According to IRS regulations, all U.S. businesses must have a Taxpayer Identification Number (TIN). Note that it is EIN for corporations and LLCs. As per a recent policy, the IRS only allows people with an ITIN or SSN to be the “responsible party” on EIN applications.

As you know, foreign entrepreneurs do not have Social Security numbers. So, they can request an Individual Taxpayer Identification Number (ITIN).

Suppose you obtained an ITIN. Then, you can apply for an EIN using Form SS-4.

Step 5: Open a Business Bank Account in the U.S.

So you wish to create an entity based in the U.S., right? Then, you have to set up a bank account based in America.

Unfortunately, the process of opening accounts in the U.S. has become complicated for foreigners. That is because of the USA Patriot Act, which was passed recently. However, do not lose hope. If you have official documentation and proof of identification, you will be able to open a bank account.

Below we have listed what you will need for the process. Take a look:

- Official corporation paperwork that includes your official business address in the U.S.

- EIN and ITIN numbers

- Your passport

Step 6: Get Required Licenses and Permits

You have to apply for licenses and permits related to your business activities, industry, and the regions where the business operates. You will have to check with the Secretary of State, local government authorities, and county clerk to figure out the requirements for your startup.

Step 7: Stay on Top of Ongoing Compliance Tasks

As an entrepreneur, you have to complete certain compliance formalities. Usually, it depends on the entity type and the location of your business. You are expected to file and pay your taxes on time. Remember that you may have to provide annual reports to the state, hold shareholder or member meetings, or renew licenses and permits as well.

It is important to stay on top of all your daily tasks. Suppose you fail to comply with reporting rules and pay the required fees. Then, it can cause you to receive penalties. Plus, you could lose your personal liability protection and business license.

Wrapping up

There you go! You learned how to set up a startup business in the U.S. You could be a U.S. citizen or a non-citizen. Either way, you can start your business in America. We explained the process that U.S. citizens have to take and the route that non-citizens have to take. Of course, if you are a non-citizen, you may have to put in some extra effort and take a few extra steps. However, you can always consult trusted professionals to guide you through the steps. That would make things a lot less stressful.

You can get assistance from accountants and attorneys who have experience assisting foreign entrepreneurs start businesses in the U.S. Even if you are a U.S. citizen, you can use the additional help that the experts bring to the table.